DuPont de Nemours Inc. has announced a blockbuster deal to sell its Aramid business, including the well-known brands of Kevlar and Nomex, to Arclin Inc. for $1.8 billion. The move is a critical move in the current transformation of DuPont to make its portfolio lean and increase shareholder value.

High-performance fibres, key to industries such as aerospace, defence, and protective equipment, are part of the sale that also places both companies in a position to capitalise on emerging market trends and navigate economic headwinds. The move will capture headlines and spark discussions within the chemical and materials industry.

Details of the $1.8 Billion Transaction

The deal will provide DuPont with approximately $ 1.2 billion in cash at the closing date, a $ 300 million note receivable, and a 17.5 per cent non-controlling equity interest in Arclin, valued at $ 325 million. The deal is expected to close during the first quarter of 2026, and in case of regulatory consent.

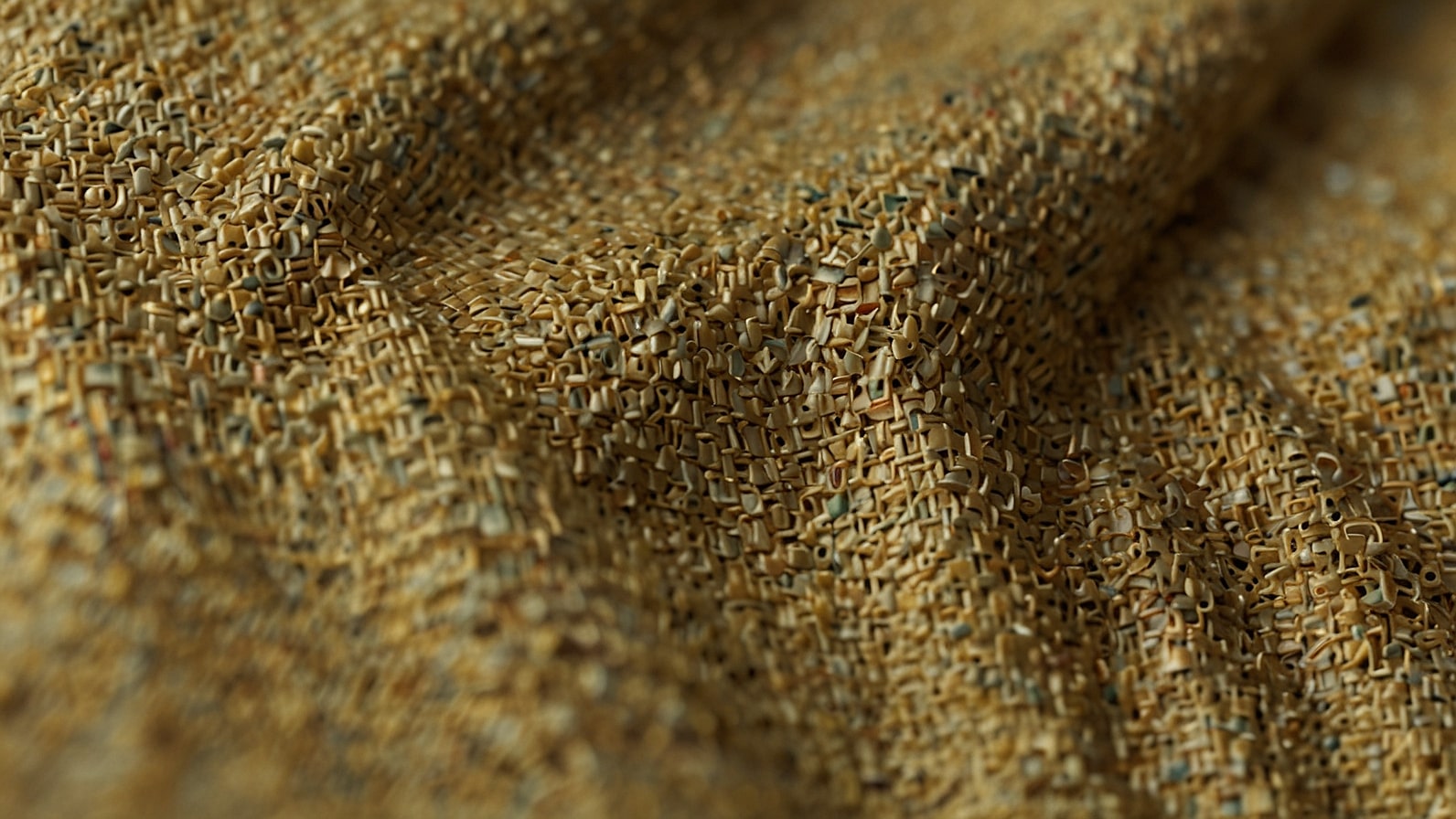

The Aramid division, with an annual revenue of approximately $ 1 billion, is the manufacturer of Kevlar, which has a wide range of applications in bulletproof vests and aerospace parts, as well as Nomex, a popular material in flame-resistant protective garments worn by firefighters and industry workers. These are the brands that have established DuPont’s historical legacy of innovation in the field of advanced materials.

Arclin is a polymer technologies company based in Georgia, supported by a private equity firm, TJC, that deals with engineered products used in construction, transportation, and industry. Arclin will expand its product range by acquiring Aramids and entering new high-growth markets, such as electric vehicles and renewable energy infrastructure, where lightweight, long-lasting materials are in high demand.

DuPont’s Strategic Transformation Accelerates

It is the most recent in a 10-year history of restructuring at DuPont. The company has been disposing of non-core assets to concentrate on high-margin and high-growth divisions.

Notable acquisitions have been the 2017 merger of Dow Chemical, the 2017 formation of Dow, DuPont and Corteva Agriscience and the 2019 spin-off of its nutrition division to International Flavours and Fragrances. DuPont is also spinning off its electronics operations on November 1, 2025, which will further narrow its focus to areas such as water solutions and advanced materials.

The sale of Aramids helps DuPont avoid exposure to mature markets where growth is slower, and the excess capital can be used in the future for acquiring new assets, reducing debt, or distributing it to shareholders. RBC Capital Markets analysts propose that the cash proceeds and equity stake would enhance DuPont’s financial flexibility, enabling it to succeed in a challenging economic environment characterised by increasing energy prices and supply chain issues.

Why This Deal Matters for Arclin

To Arclin, the purchase of Kevlar and Nomex is a game-changer. These iconic brands make it a stronger brand in its portfolio, allowing it to venture into high-end markets, such as the aerospace, electrical infrastructure, and electric vehicles.

The unmatched strength-to-weight ratio of Kevlar is ideal for lightweight composites in EV battery enclosures, and Nomex’s thermal resistance handles applications in renewable energy systems. These assets are enhanced by Arclin’s expertise in resins and surface technologies, which will lead to the creation of new products and potentially dominate the speciality materials market.

The acquisition may also portend further consolidation in the chemicals industry, with private equity houses such as TJC watching undervalued assets to grow. The increased size and diversification of the clothes sold by Arclin can make it a prospective IPO candidate or facilitate further strategic acquisitions, where it can leverage the global awareness of Kevlar and Nomex.

Market Response and Economic Context

DuPont experienced a marginally positive stock increase, ending at $ 77.56 on August 29, 2025, indicating confidence among investors in the company’s streamlined strategy.

Nonetheless, premarket trading was slightly volatile, as the broader market was concerned about declines in the tech sector and forthcoming data on inflation. The Federal Reserve’s inflation indicator showed steady inflation in July, indicating the possibility of reducing rates, which would lower the cost of borrowing and increase demand in capital-intensive sectors, such as chemicals.

The acquisition comes at a time when the chemicals industry is facing a challenging period, as dynamic energy prices and environmental sustainability regulations are impacting profitability. The shift in the direction of high-tech and environmentally friendly solutions adopted by DuPont is also consistent with an international trend, such as the digitalisation process and the adoption of net-zero emissions.

Future Implications for DuPont and Arclin

In the case of DuPont, the sale of the Aramids will contribute to its post-electronics spinoff valuation prospects, enabling it to focus more on innovation-driven segments. The equity interest in Arclin provides a tactical bridge in the future in both sustainable materials and high-tech composites.

Arclin, in the meantime, faces a dilemma in incorporating these luxury brands without compromising its market status. The key to success will be the ability to utilise the technological capabilities of DuPont to contribute to innovation in high-demand areas, such as green energy and aerospace.

This 1.8 billion deal does not only serve to remind us of the efforts of DuPont to transform but also a reminder of the dynamic nature of the chemicals industry. As the two firms look forward to closing the deal, investors and other market observers will be tracking how the move will redefine competitive environments and innovation in the speciality materials sector.